Skyro is a legit fintech brand na relatively bago pa lang sa market. They launched in the Philippines noong August 2022, and personally this year ko lang sila nadiscover.

Nakita ko na ito dati sa Play Store, pero akala ko isa lang sa mga shady online lending apps (OLA), so di ko siya pinansin.

But no—Skyro is definitely one of those legitimate brands you can trust. It’s operating under Breeze Ventures, a fintech company headquartered in Singapore. Isa siya ngayon sa mga competitors or challengers ni Home Credit.

So, let me share yung first encounter ko with Skyro and my feedback after over 4 months of using their app.

MacBook Purchase

Last April, I needed to buy a new laptop for work para palitan yung old device na 7 years ko nang ginagamit. Naisip ko na gamitin yung pre-approved product loan offer ni Home Credit.

Pagdating ko sa store, I asked about the Home Credit offer. Kaso wala yung sales associate nila at that time, so one of the staff ng store advised me to try Skyro instead.

Tinawagan niya yung Skyro sales rep to assist me with the process. Here’s how it went:

- I was instructed to download the Skyro app habang hinihintay yung agent.

- I signed up on the app and filled out the form for their product loan.

- Instant yung pre-approval! May offer agad. May QR code na kailangan ipakita sa agent.

- The agent verified all the details I submitted and asked kung magkano yung gusto kong downpayment. I said Php10,000 pero take note na 10% of the total price lang naman yung required.

- May tumawag to confirm my application (2–3 quick questions). Possible din na tawagan yung contact reference mo for verification.

- Within 10 minutes, I received an SMS and in-app notification—fully approved na!

I paid the downpayment and completed the purchase.

Mabilis lang yung process, although umabot pa rin ako ng around 2 hours sa store dahil sa paghihintay sa Skyro agent at sa unboxing ng laptop.

Skyro Loan Details

- Product price: ₱44,000

- Downpayment: ₱10,000

- Loan amount: ₱34,000

- Origination Fee: ₱4,090

- Total loan amount: ₱38,090

- Monthly installment: ₱4,274

- Loan term: 12 months

- Total payable: ₱51,288 (₱4,274 x 12)

- Total interest: ₱17,288

- Monthly interest rate: 4.90%*

- Effective interest rate: ~50.85% yearly / 4.24% monthly

So ayun, malaki nga lang yung interest. Honestly, I don’t recommend using Skyro if may iba ka pang option. Mas okay pa rin gumamit ng credit card with installment, kasi mas mababa yung interest doon.

*4.90% ang monthly interest rate na naka-indicate sa account statement ko, though I won’t go into the full details na of how Skyro computed my monthly installment amount.

Benefits of Using Skyro

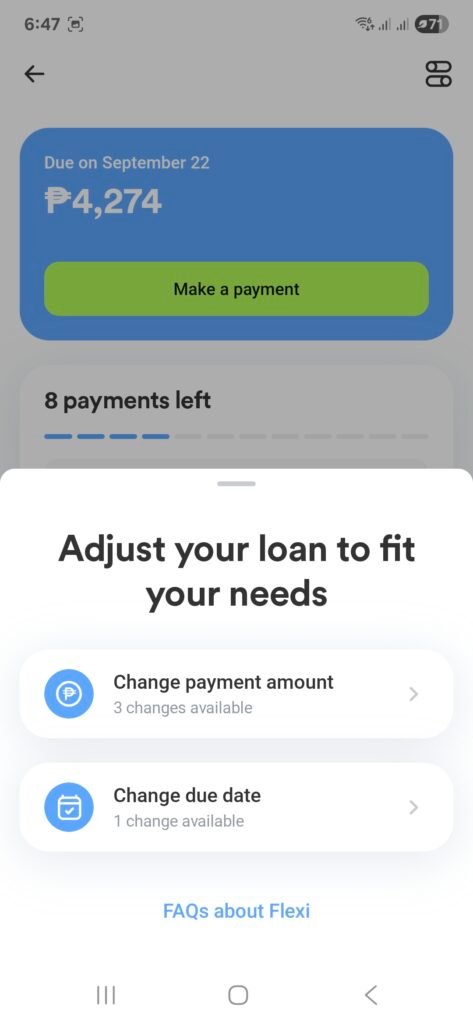

Flexible payments and due dates

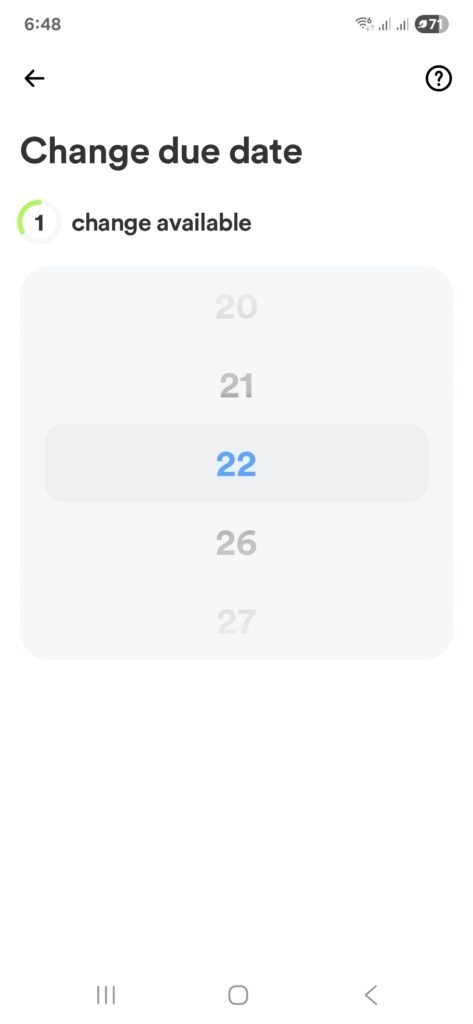

One of the best things about Skyro is the Flexi feature. You can change your due date up to 3 times during your loan term—nagamit ko na ito twice. Super helpful lalo na kapag may biglaan kang paggagamitan ng pera.

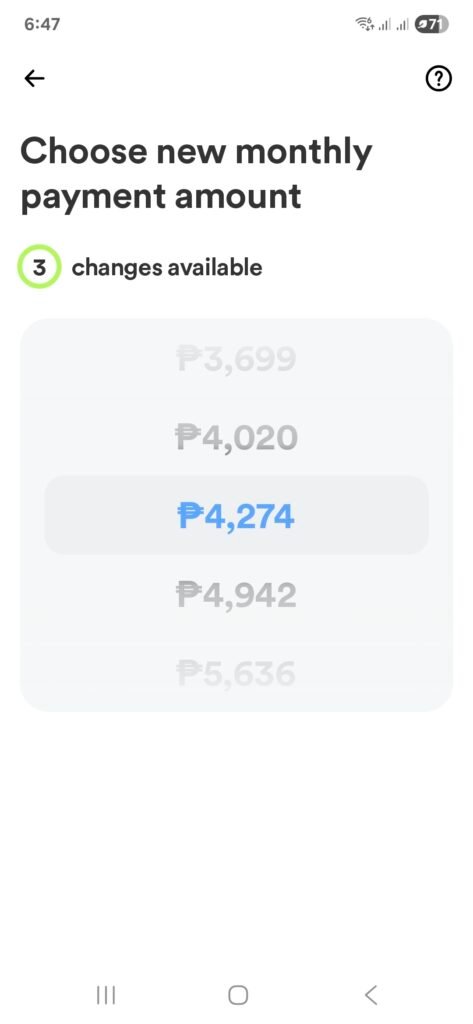

Pwede mo rin baguhin yung monthly installment amount up to 3 times. Kung gipit, you can lower the monthly payment (pero mas hahaba yung loan).

On the other hand, increasing your payment shortens the term and reduces the total interest.

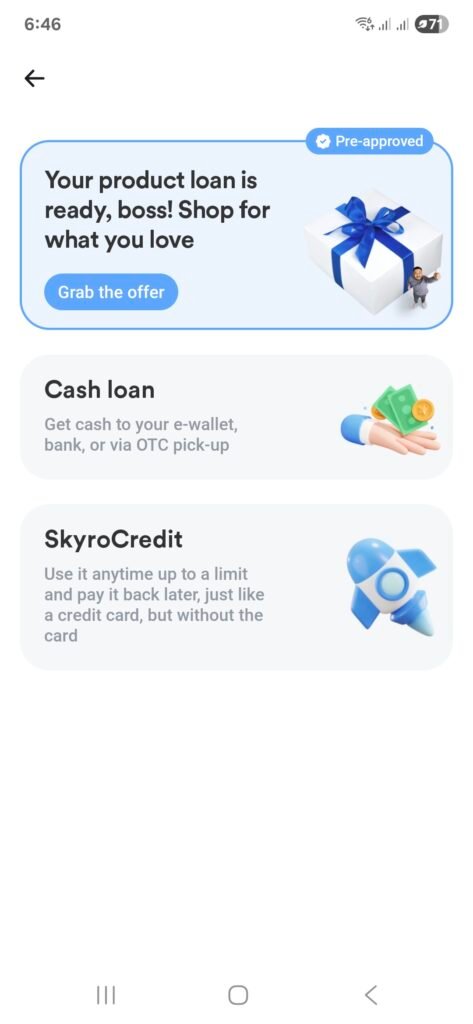

Cash Loan & Credit Line

Bukod sa product loan, Skyro also offers Cash Loan and SkyroCredit (credit line). Wala pa sa akin yung access for these two, pero I expect to unlock them once fully paid ko na yung current loan.

Interestingly, after 3 paid installments pa lang, naka-receive na agad ako ng pre-approval for another product loan.

Hindi ko pa ginamit, pero at least alam kong may option kung kailangan ko.

Final thoughts: Nalalakihan ako sa interest pero Skyro is a good alternative if you don’t have a credit card or other financing options. The approval process is fast, legit, and may helpful features like Flexi.

Available ito in thousands of partner stores nationwide—parang Home Credit din!

Leave a Reply